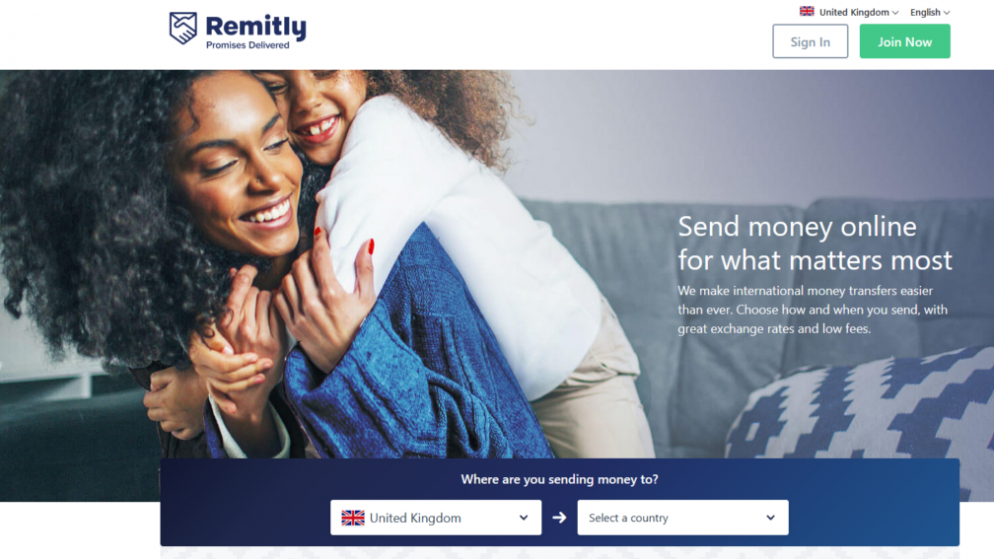

What is Remitly?

Remitly is a financial technology company that provides digital money transfer services. It allows people to send money from one country to another quickly and securely through its online platform or mobile app. Remitly is particularly focused on serving the needs of immigrants who want to send money to their families and loved ones back home.

Payment Methods Available with Remitly

Remitly supports a variety of payment methods, depending on the country you are sending money from. Generally, users can pay for their transfers using a bank transfer, a debit card, or a credit card.

Some countries may also support other payment methods such as Apple Pay, Android Pay, or SOFORT. When you initiate a transfer on the Remitly platform, you will be able to select from the available payment methods for your specific location.

How much I can transfer with Remitly

The amount you can transfer with Remitly depends on several factors, including the countries you are sending money to and from, your payment method, and your account status.

Remitly has different transfer limits for different types of users, and these limits may vary over time based on a variety of factors. In general, though, Remitly’s transfer limits are designed to accommodate both small and large transfers.

For more information about the specific transfer limits that apply to your account, you can log in to your Remitly account or contact their customer support team.

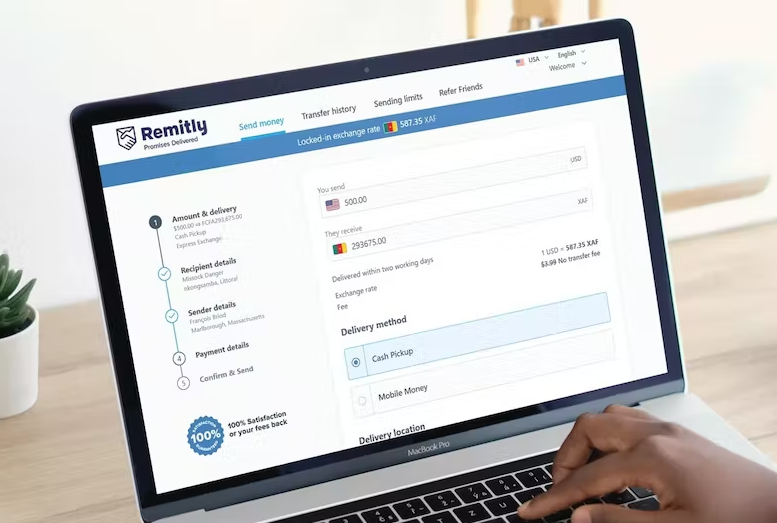

Remitly Transfer Fees

Remitly’s transfer fees depend on several factors, including the countries you are sending money to and from, your payment method, and your account status. In general, Remitly charges a fee for each transfer, which is displayed to you before you confirm your transaction.

The fee may also vary based on the speed of the transfer, with faster delivery options typically costing more than slower ones.

However, Remitly strives to keep its fees competitive and transparent, so you know exactly how much you will be paying before you initiate a transfer. You can also use Remitly’s online fee calculator to estimate the cost of your transfer based on your specific needs.

Pros and Cons of using Remitly

Here are some potential pros and cons of using Remitly for money transfers:

Pros:

- Fast and convenient transfers: Remitly offers quick and easy transfers that can be completed online or through their mobile app.

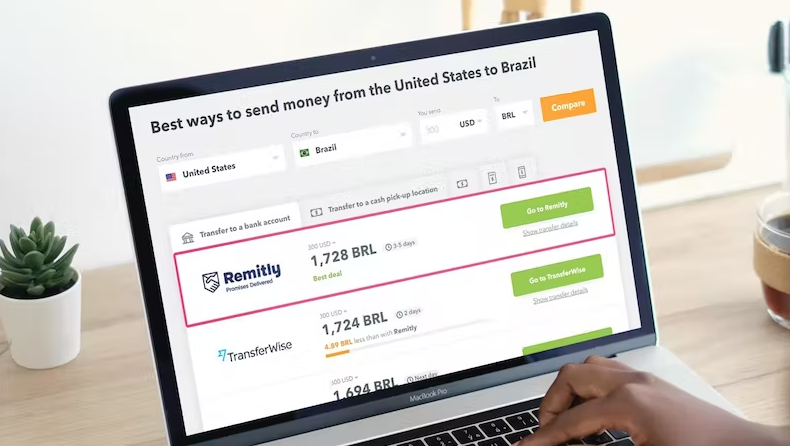

- Competitive fees: Remitly’s fees are generally lower than traditional money transfer services and they offer competitive exchange rates.

- Multiple payment options: Remitly supports a variety of payment methods, including bank transfers, debit cards, and credit cards, making it easy to send money from almost anywhere.

- Flexible delivery options: Remitly provides a range of delivery options, including direct bank deposits, cash pickups, and home delivery, allowing recipients to get their money in a way that works best for them.

- User-friendly interface: Remitly’s platform is designed to be easy to use, with clear instructions and an intuitive interface.

Cons:

- Limited reach: Remitly currently only supports transfers between select countries, which may be a drawback if you need to send money to a location they do not serve.

- Transfer limits: Depending on your account status and the countries involved, Remitly may have transfer limits that could prevent you from sending larger amounts.

- Limited support options: While Remitly offers customer support via email and chat, they do not have phone support, which may be an issue for users who prefer more direct communication.

- Currency exchange limitations: Remitly only allows users to send money in certain currencies, which may be a limitation for those who need to send money in a less common currency.

It’s worth noting that individual experiences may vary, and it’s important to do your own research to determine if Remitly is the right choice for your particular needs.

Remitly Exchange Ravtes

Remitly offers competitive exchange rates, which are updated regularly to reflect the latest market conditions. The exchange rate you receive may vary depending on several factors, including the currencies involved, the amount you are transferring, and the current market conditions.

However, Remitly aims to offer transparent and fair exchange rates to its users, and you can always check the current rate before initiating a transfer. In some cases, Remitly may also offer promotional rates or other special offers, which can provide additional value for users.

It’s important to keep in mind that exchange rates are always subject to change, and it’s a good idea to check the latest rates before initiating a transfer.

How Remitly makes money?

Remitly makes money by charging a fee for each money transfer that users send through their platform. The specific fee charged may vary depending on several factors, including the countries involved, the amount of money being transferred, and the speed of the transfer.

Remitly may also earn revenue from the exchange rate spread, which is the difference between the rate at which Remitly buys and sells foreign currencies. Additionally, Remitly may earn interest income on funds held in user accounts before they are transferred.

While fees are the primary way that Remitly generates revenue, the company aims to keep its fees competitive and transparent, and users can always see the exact fee they will be charged before initiating a transfer.

Platforms Where Remitly Is Available

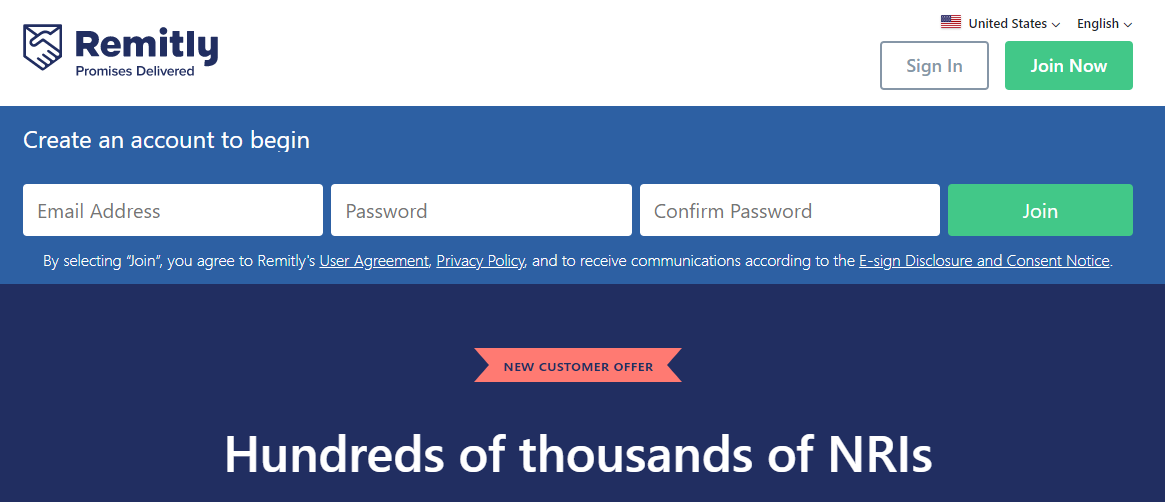

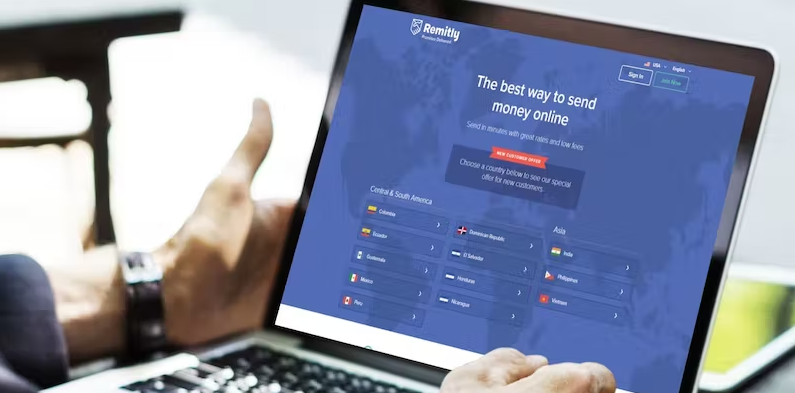

Remitly is available on both web and mobile platforms, which allows users to send money from almost anywhere. Users can access Remitly’s services through the company’s website, which is compatible with most web browsers, or by downloading the Remitly mobile app, which is available for both iOS and Android devices.

The mobile app offers all the same features as the web platform, including the ability to send money, track transactions, and manage account settings. With both web and mobile options, Remitly provides a flexible and convenient way for users to send money to their loved ones, no matter where they are.

Remitly is available in select countries, and the specific availability of the service may vary depending on the user’s location and the countries they are sending money to and from.

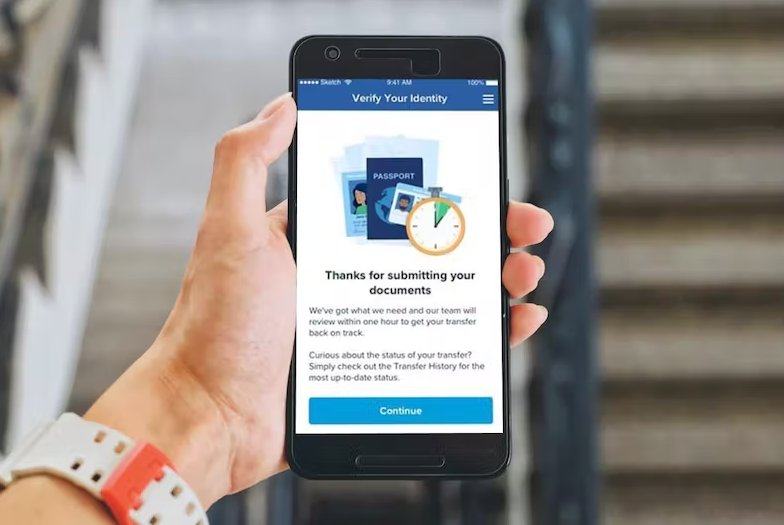

Is Remitly Secure?

Remitly takes security and privacy very seriously and has implemented several measures to help ensure the safety and security of its users. Here are some of the ways in which Remitly works to protect user information:

- Encryption: Remitly uses industry-standard encryption technology to protect user data, both during transmission and while it is stored on their servers.

- Two-factor authentication: Remitly offers two-factor authentication as an optional security feature, which requires users to enter a code in addition to their password to access their account.

- Anti-fraud systems: Remitly employs a range of anti-fraud systems to detect and prevent fraudulent activity, including monitoring for suspicious transactions and requiring additional verification for high-risk transactions.

- Regulatory compliance: Remitly is regulated by government authorities in the countries where it operates, and is required to comply with strict security and privacy standards.

- Privacy policy: Remitly has a comprehensive privacy policy that outlines how user information is collected, stored, and used, and provides users with control over their personal data.

Overall, Remitly is committed to providing a secure and trustworthy platform for sending money, and users can take steps to further protect their accounts by using strong passwords and enabling two-factor authentication.

How to Contact Remitly?

Remitly provides customer support through several channels, and users can contact the company in a variety of ways:

- Email: Users can send an email to Remitly’s customer support team at support@remitly.com. This is a good option for non-urgent inquiries or general questions.

- Chat: Remitly also offers a chat feature on their website and mobile app, which allows users to connect with a customer support representative in real time.

- Phone: While Remitly does not offer phone support, users can request a callback from a customer support representative by navigating to the “Contact Us” section of the Remitly website or mobile app.

- Help Center: Remitly has a comprehensive help center that includes articles and FAQs on a wide range of topics, such as sending and receiving money, account management, and troubleshooting common issues.

No matter which method you choose, Remitly’s customer support team is available to assist with any questions or issues you may have.

FAQ

What countries can I send money to with Remitly

Remitly allows users to send money to over 50 countries around the world, including India, Mexico, the Philippines, and many others. The specific availability of the service may vary depending on the user’s location and the countries they are sending money to and from.

How long does it take to transfer money with Remitly?

The transfer speed with Remitly depends on several factors, including the countries involved and the transfer method selected. Remitly offers two transfer options: Economy, which typically takes 3-5 business days to complete, and Express, which usually completes within a few minutes. However, transfer times may vary based on the specific circumstances of each transfer.

What forms of payment does Remitly accept?

Remitly accepts a variety of payment methods, including bank accounts, debit cards, and credit cards. The specific payment options available may vary depending on the user’s location and the countries they are sending money to and from.

Can I cancel a transfer with Remitly?

Yes, it is possible to cancel a transfer with Remitly, but the specific cancellation policy may vary depending on the transfer type and stage. Users can request a cancellation by contacting Remitly customer support, but may be subject to certain fees or restrictions depending on the circumstances.

Is there a limit to how much money I can send with Remitly?

Yes, there are limits to how much money users can send with Remitly, which may vary depending on several factors, including the user’s location, the countries involved, and the specific transfer method selected. Users can check their transfer limit by logging into their Remitly account and reviewing their account settings.