Table of Contents

Backed by one of America’s most trusted pet brands, Petco provides comprehensive, highly-customizable plans so that you can choose the perfect coverage for your budget. But is it the best choice for you and your four-legged friend?

This review will help you understand everything about Petco’s policies, including pricing, discounts, additional services, claims processing times, and more.

Table of Contents

- Does Petco offer pet insurance?

- An overview of Petco Pet Insurance

- What we like about this coverage

- What could be improved

- Is Petco Pet Insurance worth it?

Does Petco offer pet insurance?

Petco started offering pet insurance in 2017. Its plans are produced and administered by PetCoach, LLC and underwritten by the United States Fire Insurance Company, administered by C&F Insurance Agency, Inc., a Crum & Forster company, which is rated A by AM Best Company.

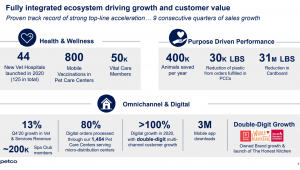

Established in 1965, Petco Animal Supplies Inc. started by providing wellness care to pets but over the years, the company expanded its business to offer a variety of pet products such as training, grooming, pet food, supplies, and even vet services through their Vetco Clinics. Today, the company has more than 1,000 stores across the US and Puerto Rico.

An overview of Petco Pet Insurance

Available plans

The company offers an Accident and Illness plan and an Accident-Only plan.

The Accident and Illness plan covers accidents, illnesses, veterinary exam fees, in-office, and veterinary clinic diagnostic and testing, chronic conditions, genetic and hereditary conditions, cancer treatment, behavioral problems, alternative therapies, prescribed medications and foods, medical supplies, IV fluids, non-routine dental coverage, surgery and hospitalization, microchip implementation, and end of life expenses.

Both plans are similar in everything, with the only difference being that the Accident-Only plan only covers unexpected accidents.

Customers need to wait 14 days for their pet coverage to go into full effect. This is valid for all accidents, illnesses, and orthopedic conditions such as ligament issues, knee conditions, and hip dysplasia.

Petco also offers a Wellness plan called Vital Care that focuses on providing a few wellness benefits that the company considers to be of the biggest importance to pet owners. The Vital Care option also comes with a welcoming gift that includes a free bag of food or $25 off one vaccination in a Vetco Clinic, 30% off on full-service grooming for dogs at any of the many Petco locations, unlimited wellness exams, and a $10 reward for each month you are on the Vital Care plan to spend in any Petco location.

Exclusions

Similar to other pet insurance companies, Petco doesn’t cover pre-existing conditions. However, the company does reinstate pre-existing curable conditions. If your four-legged friend wasn’t covered for a certain pre-existing condition but recovered from it during your policy time and has been symptom-free for 180 days from the date of recovery, Petco will include the condition in your policy.

The company also doesn’t cover the following:

- Elective and cosmetic procedures such as ear cropping, claw removal, and tail docking;

- Experimental medication or procedures;

- Heart valve or organ transplants;

- Aesthetic, cosmetic, orthodontic, or endodontic dental procedures such as fillings, caps, root canals, crowns, and implants;

- Dental cleanings when they are not used to stop or treat a condition covered in the policy;

- Anal sac expression and/or resection when there’s no disease or infection;

- Prescribed food used for weight loss or prevention, or general maintenance;

- Breeding, pregnancy, whelping, and nursing;

- Boarding;

- Grooming services and supplies;

- Training and training devices;

- Supplies and devices that can be considered preventive to an injury but not illness including ramps, toys,

- bedding, leashes, etc;

- Intentionally inflicted injuries and illnesses;

- Veterinary expenses related to coursing, racing, personal protection, guarding, law enforcement, or organized fighting;

- Bilateral conditions such as knee and ligament conditions that occurred before enrolling with Petco or during a waiting period;

- Funeral expenses include urns, caskets, burial plots, etc.

Pricing

Regardless of which plan you opt for, you can choose from four annual coverage limits ($5,000, $10,000, $15,000, $20,000, or unlimited), three reimbursement percentages (70%, 80%, or 90%), and three annual deductibles ($100, $250, or, $500).

Individual premium prices are based on breed, age, and location.

Discounts

Petco offers a 10% discount for enrolling multiple pets from one family.

There is also a 30-day money-back guarantee. If you pay for the first premium but you are not satisfied with your policy, you will get a full refund. This is only available to customers who are not residents in the state of New York and those who haven’t filed any claims within this 30-day period.

Claims and reimbursement times

Customers can submit their claims via the company’s online portal within 270 days and get the reimbursement through a mail check or a direct bank deposit. They also have the option to apply for a direct vet bill payment, which means the insurer will pay the vet for their services directly.

The company takes about 30 days to process claims. The customer will receive email notifications as their claim is being processed and they can also track it in their Petco Wellness dashboard.

What we like about this coverage

Petco offers a pet concierge service free of charge with each pet insurance policy, which includes guidance from Petco’s certified pet health professionals and veterinary consultants. Policyholders can access this service through their account or mobile app anytime to ask questions related to their pet’s health, nutrition, and general well-being.

Petco’s pet insurance plans are pretty comprehensive, covering veterinary exam fees, alternative therapies like acupuncture, behavioral problems, prescribed diets and medications, as well as microchip implementation.

Another upside is the short waiting period for orthopedic conditions – only 14 days. Other pet insurance providers (such as Embrace) require you to wait for six months.

Petco pet insurance doesn’t have upper age limits. Any dog or cat older than eight weeks can enjoy the benefits that come with Petco’s pet insurance plans. We also liked that there’s no lifetime or per-incident payout limits with the company’s plans.

Petco doesn’t require a veterinary exam prior to enrolling.

The company’s wellness care option (Vital Care) can be purchased as a standalone and comes with unlimited wellness visits and discounted grooming services.

Your pet is covered when they travel with you in the States, Canada, Puerto Rico, Guam, U.S. Virgin Islands, and other U.S. territories.

What could be improved

While other pet insurance providers offer a number of preventive care benefits such as spaying/neutering, parasite control, lab tests, and dental cleanings, Petco’s wellness plan Vital Care provides just a few benefits that the company believes owners will “actually use and benefit from.”

Petco’s premiums are higher than average, especially when it comes to purebred dogs and cats that reside in urban areas.

The company doesn’t cover bilateral conditions involving the knee, meniscus, cruciate ligament, and patella.

There’s a 14-day waiting period for accidents, which is longer compared to other providers. For instance, Embrace covers accidents after 48 hours, Pets Best after three days, and Figo after five days.

The claim processing time is also longer compared to other pet insurers. For example, while Petco takes 30 days to process claims, Embrace and USAA usually process claims within 10 to 15 business days.

Is Petco Pet Insurance worth it?

Petco Pet Insurance has competitive coverage and a variety of customization options to fit every customer’s needs and budget. If you were denied pet insurance for older pets in the past, this provider may offer you a solution. However, the company’s premiums are more expensive compared to other insurance providers.

If you’re still looking for an alternative, compare pet insurance providers on Pawlicy Advisor to see how each one stacks up, with a clear explanation of benefits and exclusions. We help you save time