Table of Contents

Managing your money is essential if you want to live a happy and prosperous life. And one of the best ways to do that is by using a budgeting software like Quicken. In this blog post, we will explore some of the basics of how to manage your spending with Quicken. We’ll talk about how to create a budget, track your expenses, and adjust your spending as necessary. So whether you’re just getting started with budgeting or want to take things to the next level, read on for tips and tricks on how to use Quicken effectively.

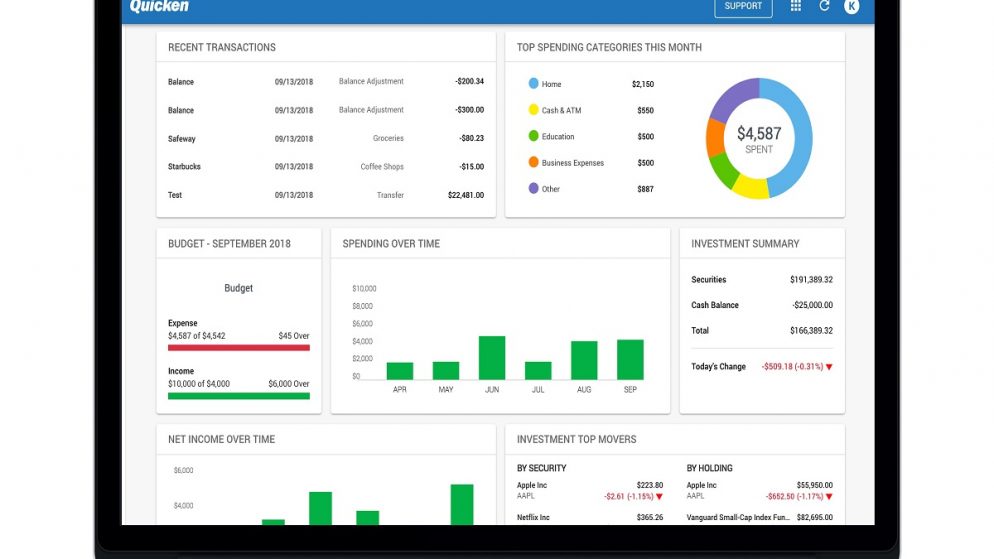

How to set up a budget?

Image Source: Link

Setting up a budget can be a chore, but with the right tools, it can be manageable. Quicken can help you keep track of where your money is going and whether you’re spending too much or not enough. In this tutorial, we’ll walk you through the process of setting up a budget in Quicken.

First, we need to identify our baseline expenses. These are the costs that we expect to incur every month no matter what. We might have things like groceries, rent, and utilities as baseline expenses.

Once we have our baseline expenses set, we need to create account categories to groups our expenses into. We could break these categories down even further and create separate accounts for groceries, bills payments (rent/mortgage), entertainment, etc. This will make tracking our spending much easier later on!

Next, it’s time to start tracking our actual spending! We want to enter all of our expenses into Quicken as soon as they happen so that we can get an accurate picture of where our money is going and make adjustments accordingly.

If there are any discrepancies between what we’ve entered in Quicken and what we actually spent on items that month, it’s time to take a closer look at our spending habits and see where we might need to adjust them. Once we have a good understanding of where our money is actually going each month, it’s much easier to make smart budgeting decisions.

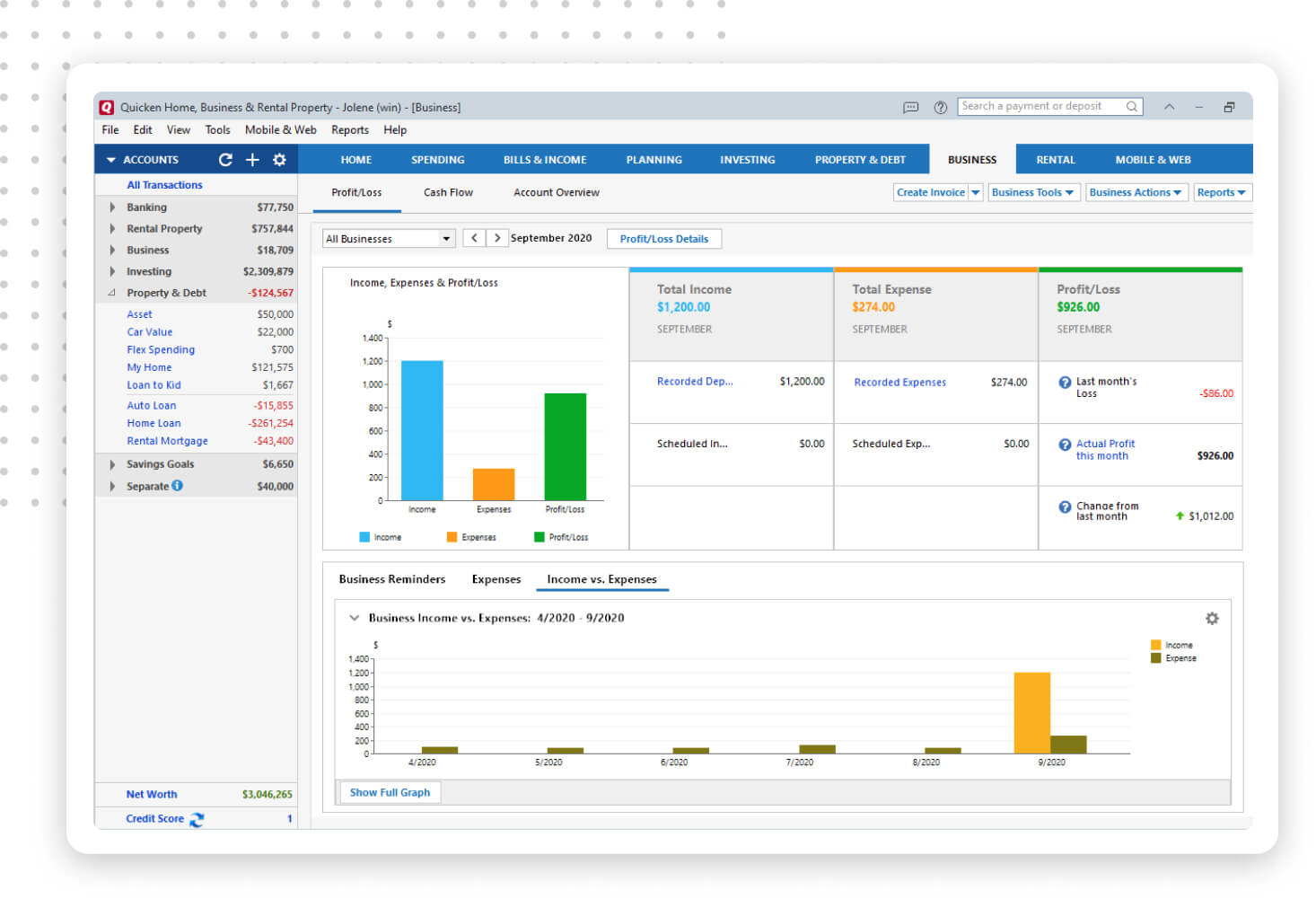

How to adjust your budget?

Image Source: Link

Budgeting is an important part of managing your spending, and Quicken can be a helpful tool for doing so. This guide will show you how to adjust your budget using Quicken, and how to make the most effective use of your money.

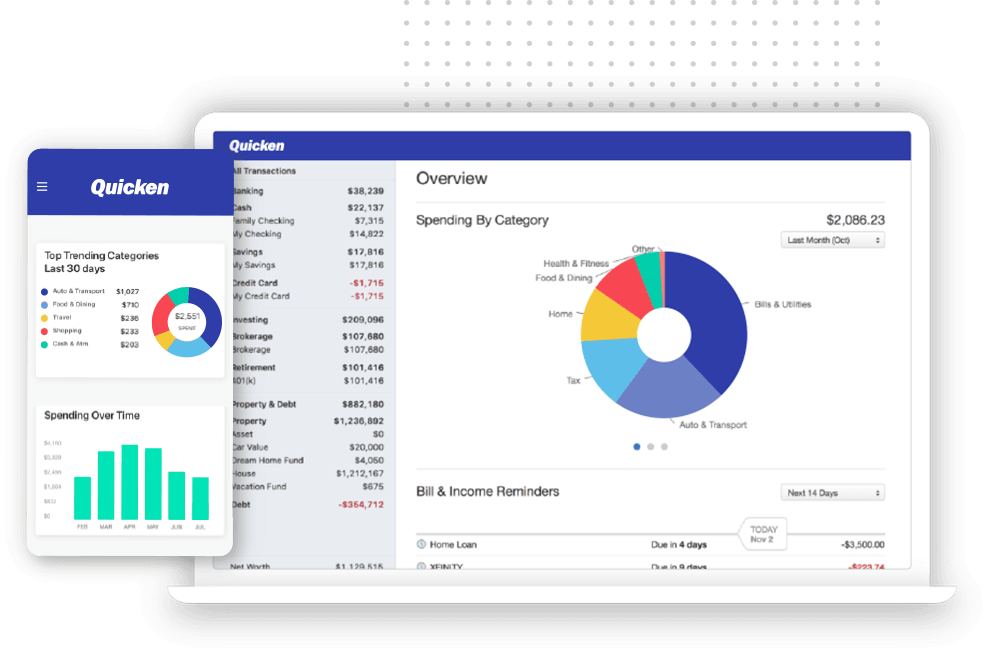

How to pay your bills on time?

Image Source: Link

Managing your spending with Quicken can be a daunting task, but it’s important to do so in order to avoid running into financial trouble. Here are some tips on how to pay your bills on time:

- Create a budget and stick to it. Before you start editing your Quicken reports, create a budget that outlines how much money you have available each month for discretionary spending. This way, you won’t be so tempted to overspend when you see that there’s still money left in your account.

- Track your expenses closely. When checking off expenses in Quicken, make sure that you’re tracking all of the relevant information, such as the date of purchase, the cost of the item, and any taxes or fees associated with the purchase. This will help you stay accountable for your spending and ensure that you’re not unnecessarily over-consuming.

- Revise your spending habits if necessary. If you find that you’re consistently overspending on certain items, consider adjusting your spending habits accordingly by limiting your exposure to these types of products or services. Doing so may require some effort on your part, but it’s worth it if it helps improve your financial situation overall.

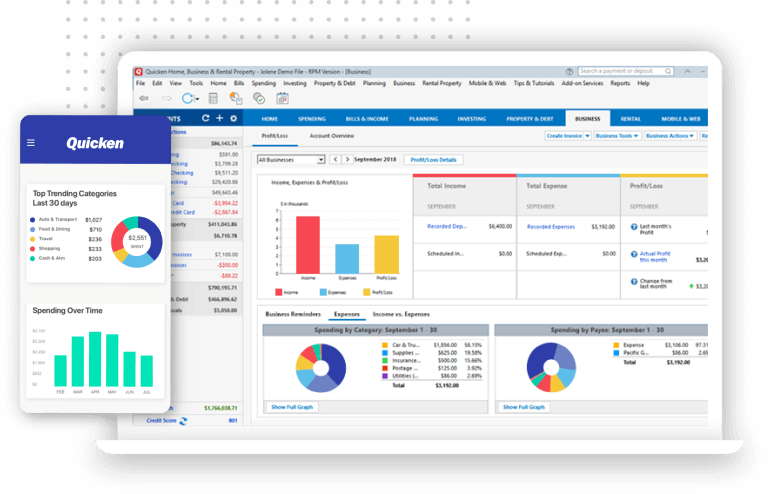

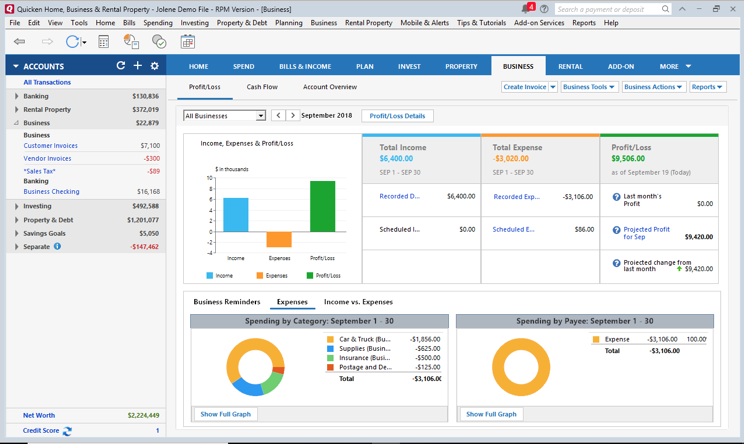

How to invest your money?

Image Source: Link

If you want to make smart spending decisions and manage your money wisely, using a finance software like Quicken is a great way to start. Here are some tips on how to use Quicken to help you save money and invest for the future.

- Create realistic budget goals. Before you open Quicken, write down your monthly income and out-of-pocket expenses. Determine which categories will require the most attention in order to save money, such as groceries, living costs, or utilities bills. Once you have a rough idea of where your money is going each month, it’s time to create a budget.

- Set up automatic payments for debts and bills. If you have debt or any other bills that need to be paid automatically (like rent or car insurance), set up payment schedules in Quicken so that everything gets taken care of on autopilot. This way, you won’t have to worry about missed payments or feeling overwhelmed by pending obligations.

- Consider investing your money wisely. One great way to save money and invest for the future is through robo-advisor services like Betterment and Wealthfront® . These services allow you to enter all of your financial information once, then let the software do the heavy lifting—investing the right amount of money into stocks, bonds, and other assets based on your risk tolerance and investment goals.

- Keep an eye on your credit score. Keeping your credit score in check is essential if you want to be able to borrow money or get approved for a loan in the future. Quicken can help you monitor your credit score and make sure that you’re taking necessary steps to keep it healthy.

- Use Quicken to track your spending. One of the best ways to learn how to save money and invest for the future is to track your spending habits using Quicken. This way, you can see where you can cut back on your expenses and where you might be overspending. Using this information, you can start developing a plan to save more money and invest for the future.

Conclusion

Image Source: Link

If you’re like many people, you might be struggling to manage your spending and stay within budget. If this is the case, then Quicken can be a great tool to help you out. In this article, we will show you how to use Quicken to help manage your finances and stay on track. We’ll also discuss some common money mistakes that people make, and advise on how to avoid them. Hopefully, by reading this article, you will be able to better understand how Quicken works and use it as a powerful tool for financial management.