Table of Contents

- When trying to save, start by documenting what you spend each month.

- Create a spending plan using the money you have left after your bills and necessities.

- Making a budget can help you manage an emergency.

- Estimate unknown expenses with a simple formula.

- Avoid surprise expenses by anticipating upcoming costs.

- Don’t forget to add a buffer to your budget to account for surprise purchases or unexpected expenses.

- A budget can prevent high-interest debt and help you pay off balances faster.

- Conclusion

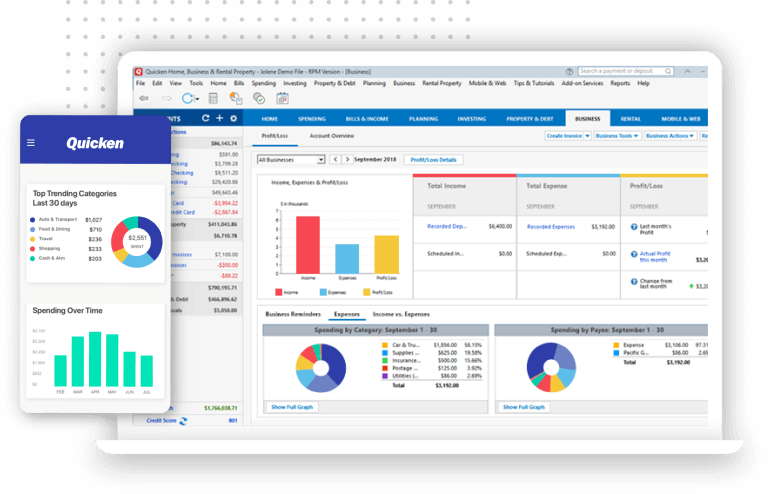

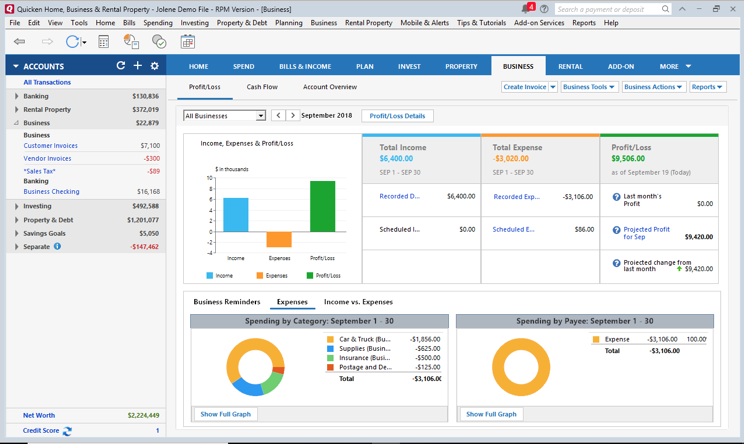

The best way to start managing your spending is by tracking and budgeting. You can use Quicken to create a spending plan and track your expenses, making saving money and avoiding high-interest debt easier.

When trying to save, start by documenting what you spend each month.

Image Source: Link

A budget is a plan for spending your money, but it’s up to you to figure out how much should be spent where. That’s why tracking your spending is the first crucial step in creating a budget that works for you. Quicken helps you do this by providing all the tools you need—it doesn’t matter if you want to use an app, spreadsheet or paper notebook.

Once you know what your spending looks like month after month, it’s time to start planning ahead and setting goals. After all, part of managing your money involves making sure there are enough funds available when unexpected expenses come up—and they always seem to come at exactly the wrong time!

Create a spending plan using the money you have left after your bills and necessities.

The next step is to determine how you’re going to use this remaining money. You can use the Quicken Spending Tracker tool or create a new spending plan by clicking File > New and selecting Spending Plan from the dropdown menu.

Once you’ve created your first spending plan, you can add more categories by clicking Add Category. Once they’re all added, enter the amount of money left over in each category so that Quicken can calculate how much discretionary income you have at the end of every month.

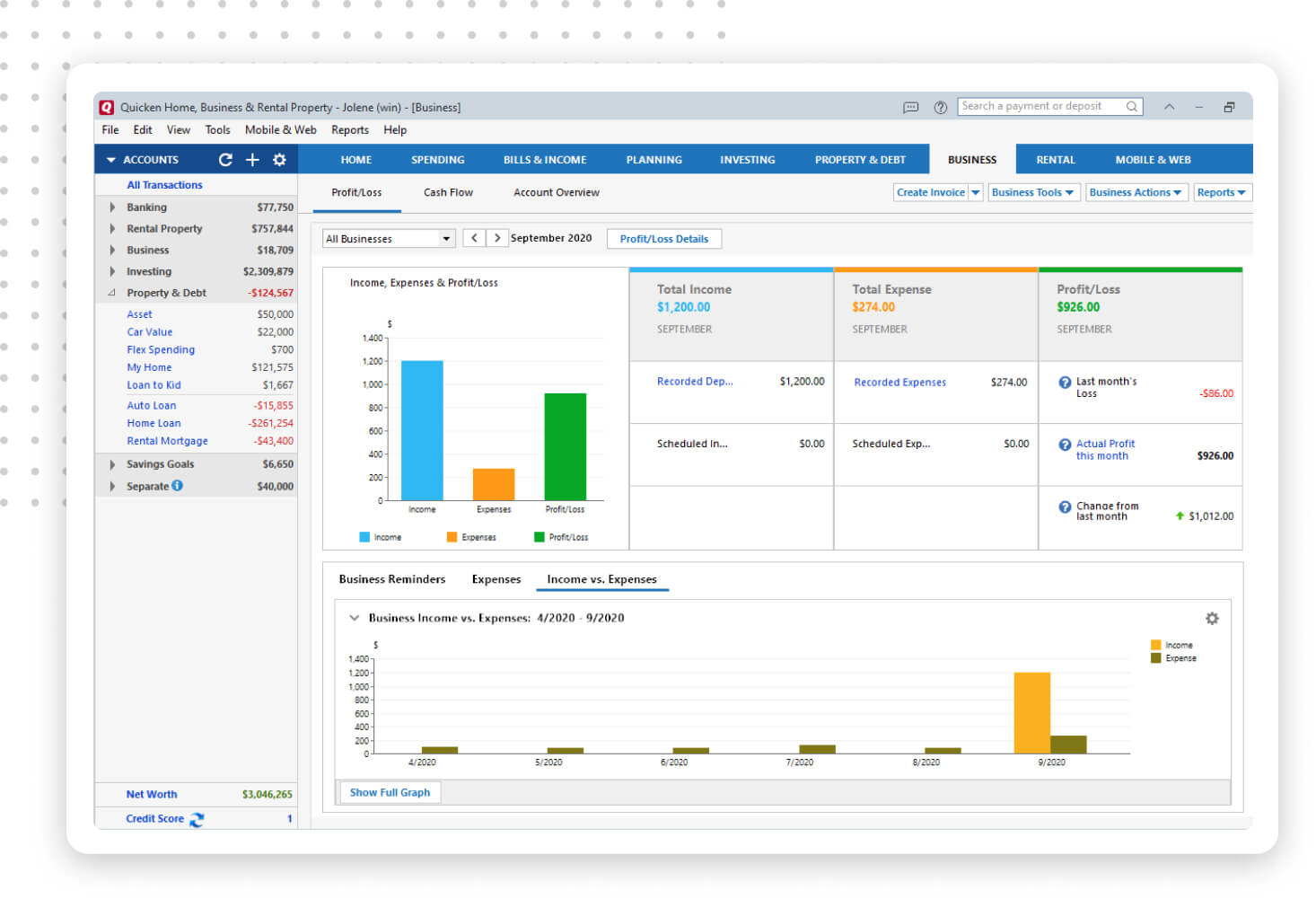

Making a budget can help you manage an emergency.

Image Source: Link

Making a budget can help you manage an emergency. An emergency is a surprise expense that you didn’t expect, like being in a car accident or losing your job. When something unexpected happens, it’s hard to know what to do with the money coming in. A budget helps you decide how much money is going out and coming in on a regular basis, so if something happens unexpectedly, there’s some flexibility in the budget to handle it while sticking to your financial goals.

If something unexpected happens—like someone loses their job or has an accident—it’s hard to know what to do with all that extra money suddenly coming in. A budget helps contain those expenses and make sure they don’t go over budget for the month or year. You can also use this method for planning for future bills: putting aside money each month until they’re due will make paying them easier when they come due!

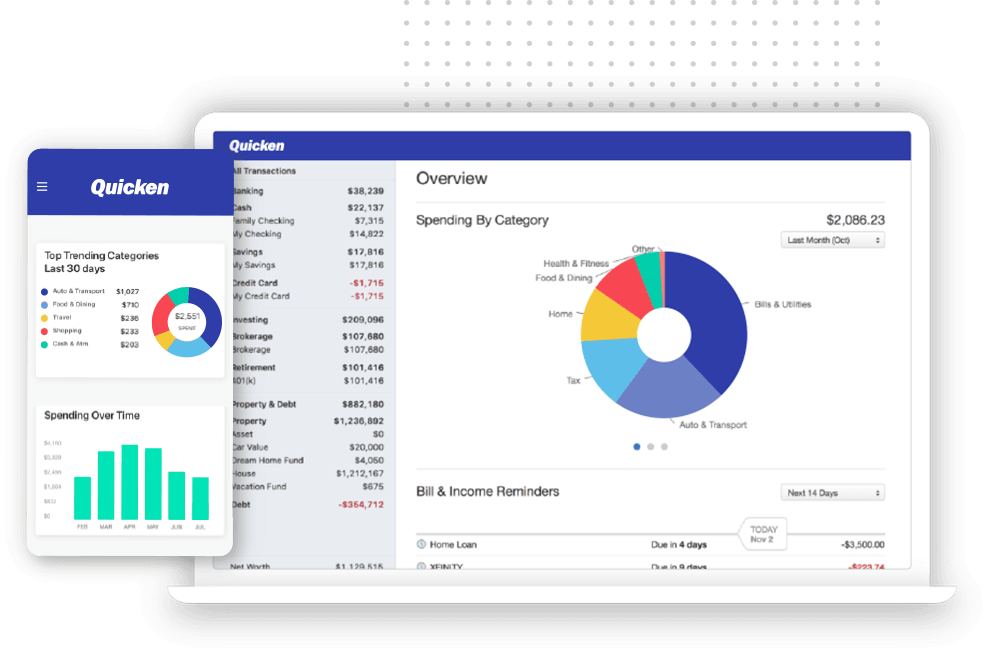

Estimate unknown expenses with a simple formula.

Image Source: Link

If you want to get a more accurate idea of how much you’ll spend on a particular category, start by budgeting for it. Then, add an additional amount that represents your average monthly spending over the last six months. This is called the buffer, and it will help account for expenses that occur irregularly or unpredictably (like car repairs). The size of this buffer depends on your financial situation and personal preferences—if there are any big upcoming expenses that could throw off your budget, like buying a car or going on vacation, add an extra $100 per month to each of those categories until they’ve passed.

However you decide to do it, putting aside some money in anticipation of unknown expenses will prevent unexpected changes from throwing off your budget too badly!

Avoid surprise expenses by anticipating upcoming costs.

Image Source: Link

As you go through your budget, be sure to consider these factors:

- Your monthly bills. Make a list of the bills you have to pay every month, and make sure you don’t forget any. If your cable bill is due on the first of every month, but your cell phone bill is due on the fifteenth—make a note of it so that you can anticipate which expenses will come up in each month.

- Hidden costs of owning a car. If you own or lease a car, remember that there are many hidden costs associated with driving. These include maintenance fees (such as oil changes), insurance premiums, gasoline and toll fees—and they add up fast! Be sure to account for all these expenses when creating your budget so that they don’t catch you by surprise later on down the line when they show up in their monthly bills.

- Unexpected expenses & unexpected income. Even if we try our best not to spend money unnecessarily (or impulsively buy things), emergencies happen all too often: Someone gets sick or has an emergency medical expense; someone needs last minute tickets for an event; or maybe one yearns for some exotic vacation but doesn’t want their partner know how much money was spent! In any event where one suddenly needs extra cash unexpectedly (or just wants extra cash without having asked permission from their partner), Quicken can help track those transactions so nothing goes unnoticed!

Don’t forget to add a buffer to your budget to account for surprise purchases or unexpected expenses.

Image Source: Link

Don’t forget to add a buffer to your budget to account for surprise purchases or unexpected expenses. For example, if you don’t have room in your budget for an extra expense, then use the Money Matters category to set aside money from each paycheck until you reach $100.

You can also create this budgeting buffer on the fly: When you receive an unexpected bill or other expense, just enter it as an unplanned expense and move on with your day. Later when you look at your finances in Quicken, that amount will be there waiting for you in the Money Matters category.

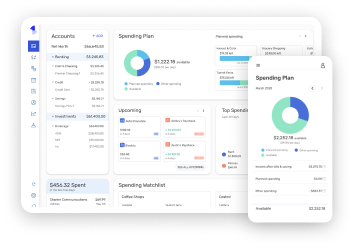

A budget can prevent high-interest debt and help you pay off balances faster.

Image Source: Link

Your budget is your plan for how you’ll spend your money. It helps you identify areas where you can save, and it’s a good way to keep track of how much you’re spending on different things.

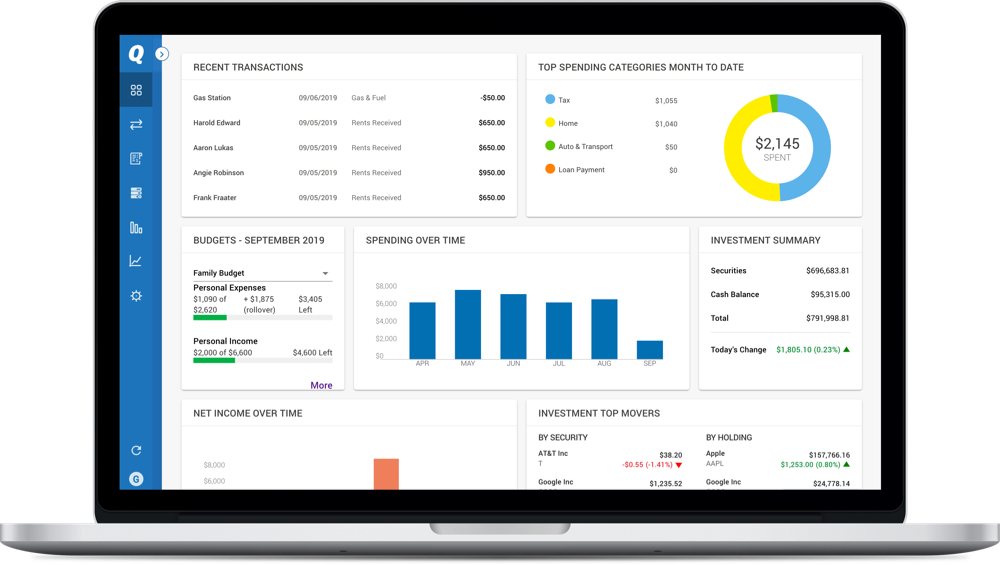

If you’re someone who has trouble sticking to a budget, Quicken can help. The steps below will show you how to create one within Quicken:

- Click the Budget tab in the toolbar at the top of your screen or click “Schedules” from the dropdown menu next to it (in Quicken Home & Business).

- Under “Create New Budget,” enter a name for this new budget and choose whether this is an ongoing monthly or quarterly expense (or something else). Then add categories by clicking “Add Category,” typing in its name and selecting whether this category should be included in income or expenses only (or both). Click Done when done adding categories and entering amounts for each category so that they show up in green font with blue borders around them; otherwise they won’t appear as part of your overall balance sheet data when opened later on!

Conclusion

Image Source: Link

Now that you know how to make a budget, it’s time to start tracking your spending! Once you’ve got all the data in place and are ready to see what your budget looks like, use Quicken Online or download Quicken 2019 to make sure that you stay on track.